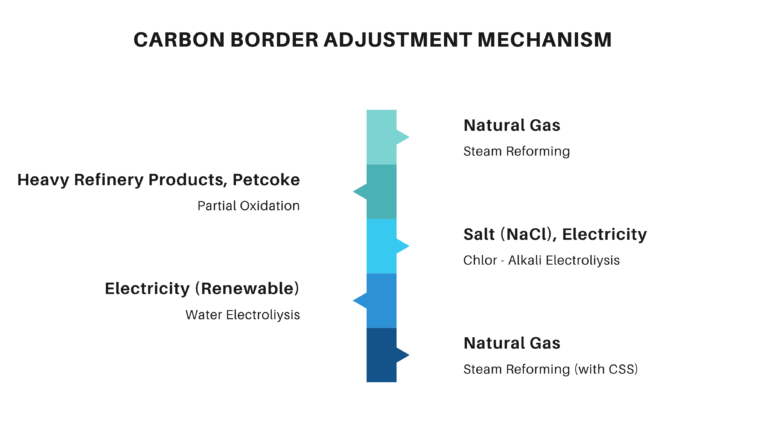

The CBAM could be an important milestone for hydrogen producers. Countries or companies exporting hydrogen to the EU market will be subject to a CBAM tax depending on the energy sources used to produce the hydrogen. This could create an incentive in favor of hydrogen production based on clean energy sources and increase the costs of producing high-carbon hydrogen. As a result, CBAM could be a driving force aimed at promoting more sustainable and environmentally friendly methods of hydrogen production.

The hydrogen sector should follow these new regulations and increase investments in clean energy sources to reduce its carbon footprint. In addition, countries and companies doing business with the EU should review their strategies to adapt to the changes brought by CBAM and gain a competitive advantage.

In conclusion, CBAM is an important mechanism to promote compliance with the EU’s environmental objectives. It could have significant implications for hydrogen producers. The hydrogen sector must adapt quickly to these changes and strive for a sustainable energy future.

Turkey has a significant potential for hydrogen exports. CBAM can incentivize countries to move towards clean and sustainable methods of hydrogen production. Moreover, to avoid paying tax related with CBAM, importers may also prefer clean hydrogen.

CBAM’s impacts on the hydrogen sector could lead hydrogen producers and suppliers to encourage sustainability-oriented investments and shift towards clean energy sources. This could make clean hydrogen more widely available and affordable in the future. Also, this could be a positive development for both the environment and the economy.