The Carbon Border Adjustment Mechanism (CBAM) is an important policy initiative developed by the European Union as part of its efforts to combat climate change. The CBAM is a mechanism that aims to align the EU’s external trade with sustainability goals. It foresees a system to calculates the carbon footprint of imported products. Also, taxes, which will be paid by importers, on this carbon footprint are calculated. Thus, the CBAM aims to encourage low-carbon products to gain a competitive advantage in the EU market and to raise the costs of high-carbon products.

CBAM is an environmental policy instrument designed to impose the same carbon costs on imported products that plants operating in the European Union (EU) would incur. By doing so, CBAM reduces the risk of the EU missing its climate targets due to the relocation of production to countries with less ambitious decarbonization policies (so-called ‘carbon leakage’).

Under CBAM, in the definitive (post-transition) period, EU authorized declarants representing importers of certain goods will purchase and surrender CBAM certificates for the embedded emissions of the goods they import. The price of these certificates will be derived from the EU Emissions Trading System (EU ETS) allowance price. Furthermore, the monitoring, reporting and verification (MRV) rules are designed based on the EU ETS’s MRV system. This will equalize the resulting carbon price between imported goods and goods produced in facilities participating in the EU ETS.

Let’s concentrate on the potential effects of this mechanism on the hydrogen industry. Hydrogen has great potential as a clean energy carrier. Besides, it is a key raw material for sectors such as iron and steel sector and ammonia production. It is a promising resource that supports the EU’s climate targets. But hydrogen production can lead to high carbon emissions, especially when produced in conventional ways.

Under CBAM, hydrogen is defined as a simple good as the raw materials and fuels used in its production are considered to have zero embedded emissions.

There are no relevant precursors for hydrogen. However, hydrogen may be a relevant precursor for use as a chemical feedstock to produce ammonia or for other processes where it is produced separately to produce pig iron or direct reduced iron (DRI).

Hydrogen can be produced from a variety of feedstocks, including plastic waste, but is mostly derived from fossil fuels. Hydrogen production units are typically integrated into larger industrial processes, such as an ammonia production plant.

The direct emission monitoring system for hydrogen include all processes directly or indirectly linked to hydrogen production and all fuels used in hydrogen production. Syngas or hydrogen production in refineries or organic chemical plants is excluded, where hydrogen is used only in these facilities and not in the production of goods covered by CBAM.

Targeting embedded carbon emissions of products imported into the EU for EU countries and countries covered by the EU Emissions Trading System and for specific sectors at highest risk of carbon leakage. These are: cement, iron and steel, aluminum, fertilizer, hydrogen and electricity.

The hydrogen sector has to take into account both direct emissions and indirect emissions during the transition period. Indirect emissions must be reported separately.

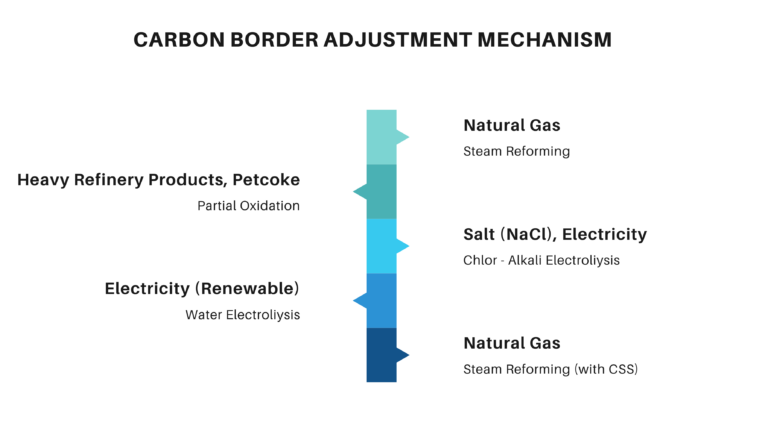

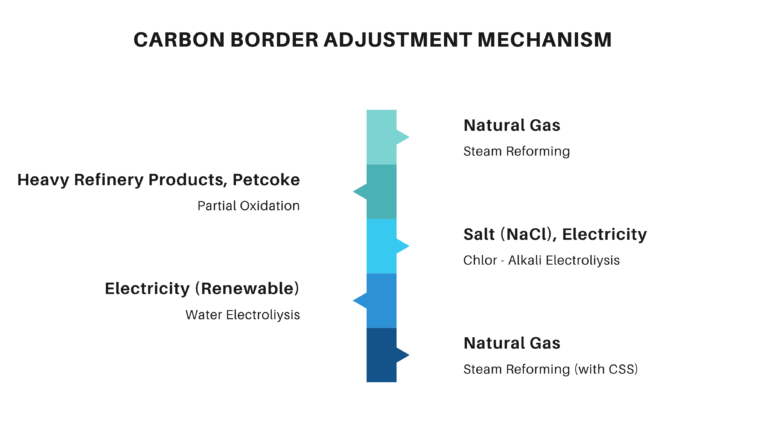

Emissions must be reported as emissions in metric tons of CO2 equivalent (tCO2e) per ton of output. This value should be calculated for the specific facility or production process in the particular country of origin. Figure 1 shows the production routes defined for the Hydrogen Sector in CBAM.